HSBC keeps up the time with modern customer-friendly technologies and of course has its own applications. It can be difficult to sort out all the variety of programs, and we'll help you with it in this article, which contains screenshots. We'll also tell you about interesting features. Let’s start!

The HSBC mobile app is a useful and multifunctional software. To start using the program all you need is download it from App Store or Google Play, depend on the OS you have on your smartphone. There is no difference between Android and iOS HSBC apps.

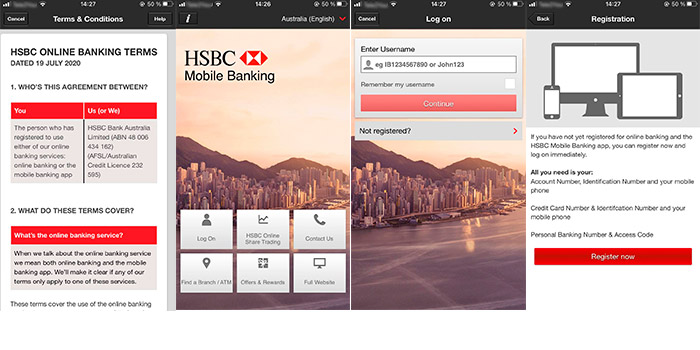

Launch it and select your country. Now you see the screen with six boxes (the interface for different countries may have slight differences). Looks simple, doesn't it?

The first box suggest you to log on. The rest of the boxes, except for “Contact Us”, on the first page are redirected to the browser. Tap the first one and just enter the username and mark “Remember my username” if you like. Continue. Then you need to verify yourself with a Secure Key. That’s all. Enjoy using the HSBC mobile banking app.

Screenshots of HSBC Mobile Banking for Australia clients

What if I'm not registered in the HSBC mobile app?

Easy. Once again, tap the first box, and you will see “Not registered” bellow the box. A window with information will appear. Prepare stuff from any line of the text and tap “Register now”. Now you see a very long page with Terms and Conditions. Mark the agreement box and click “Continue” to proceed.

There are three registration options, depending on whether you have prepared: Account/Credit Card/Personal Banking Number. Enter number you have. Go through the security procedure. Well done! The HSBC mobile app is at your service.

Sign up for the HSBC Mobile App

Note! You won’t get some paper documents automatically anymore. To return the option, contact the bank.

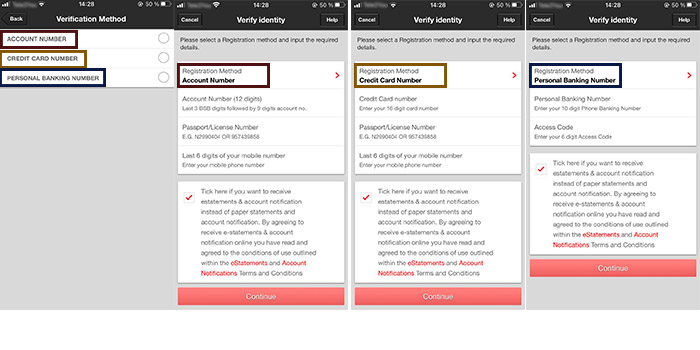

Although the general HSBC app is available for all countries with a bank branches, separate apps are for some regions. For example, when launching the main mobile bank in UK, you will be redirected to download HSBC UK Mobile Banking.

HSBC UK Mobile Banking App

Download the HSBC UK mobile app. You can select UK on the HSBC Mobile Banking homepage, and you will be taken to the desired store page. After downloading, launch the application and read Terms and Conditions. Mark the agreement line and push “Continue”. The app will greet you with something like “Good Afternoon” and suggest entering the username. You can also mark the box below to save it to the system. After that go through the security procedure. Now all the possibilities of HSBC Mobile Banking are available to you!

Screenshots of HSBC Mobile Banking for UK clients

Transferring HSBC app to a new phone

If you want to have the HSBC app on a new phone, take the old one and demobilize Digital Security Device first in the program on it. Take care of it when changing phones! Then download the software to the new device and follow the login procedure step by step according to the information we wrote above.

HSBC payment limits for the app

There is a payment limit; it can be different for branches. For example, for UK clients it is £10,000. However, you can change the limit in any direction in the settings of your HSBC mobile app.

Bad sides of using HSBC UK mobile banking

Like anything human-made, HSBC UK Mobile app isn't perfect either. It’s not about possibilities and functions, but about the stability of the program. Sometimes updates break the application or cause errors. Start using the mobile version, and it becomes necessary to have a phone every time you generate security code to log into Web version. We hope the developers are going to optimize the application.

HSBC and zelle

You can’t use zelle for HSBC UK, it is only for USA clients.

Contacting HSBC via WhatsApp and other sources

Be careful if someone offers to contact HSBC UK bank via WhatsApp. This could be a scam! This opportunity is only open to HSBC Hong Kong. The best and safest way to find out information is a direct call.

Find out also about other UK banks on our website